What number of bitcoin customers are there? How ought to we outline a bitcoin consumer? An evaluation for categorizing and monitoring consumer development in comparison with different estimates.

The beneath is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Be aware: This text doesn’t embrace all the information and evaluation. The entire piece could be discovered right here.

Bitcoin Consumer Adoption

One of many strongest circumstances for bitcoin is its rising community results. For bitcoin to proceed to develop sooner or later, it wants adoption and demand. That demand comes from both development in additional capital flowing into the community and/or development in its variety of customers.

But, defining somebody who makes use of the Bitcoin community or is a consumer of bitcoin the asset is extremely troublesome and may have many definitions relying on whom you ask. This piece goals to mixture and analyze the assorted definitions and estimates for bitcoin customers, outline our most popular view of bitcoin adoption and make our personal estimations for present bitcoin customers.

How Do You Outline A Bitcoin Consumer?

There’s no “proper” reply in defining a bitcoin consumer however we thought of the next questions when arising with our definition:

- Is somebody who’s storing bitcoin on an alternate thought of a consumer or ought to we solely rely those that have some type of self custody?

- What’s the nuance between counting on-chain addresses versus accounts or entities?

- Is there a threshold of bitcoin possession that we should always think about for adoption? Is that threshold denominated in bitcoin, fiat foreign money or as a share of internet wealth?

- Is a consumer outlined as somebody who simply holds bitcoin or do they should actively transact on-chain or on Lightning?

- Would a service provider who makes use of the Lightning Community cost rails due to the cheaper charges however elects to instantly convert funds to fiat foreign money be a consumer?

- Does a consumer must run a node?

It’s seemingly greatest to consider bitcoin consumer adoption in phases or as completely different buckets. Some tough classes to consider completely different consumer varieties:

- Casually : Consumer proudly owning any quantity of bitcoin or bitcoin-related product. This could possibly be somebody with $5 in an outdated pockets, a share of GBTC or somebody who dabbled with shopping for a small quantity of bitcoin as soon as on Coinbase.

- Allocator/Investor: Consumer who purchases bitcoin or bitcoin-related merchandise on a recurring foundation. Primarily occupied with making monetary achieve on bitcoin’s potential value appreciation. Might or might not self custody or use a custodial answer. Seemingly has 1-5% allocation of their internet value in bitcoin/bitcoin merchandise.

- Heavy Consumer: Consumer who shops a good portion of internet value in bitcoin by way of self custody and/or actively engages in on-chain or Lightning transactions. Somebody primarily occupied with utilizing a separate type of cash and financial community. Seemingly has greater than 5% allocation of their internet value in bitcoin.

Lots of the eye-popping adoption numbers that we see right now have a tendency to trace these classes collectively. Perhaps that’s the correct strategy for a high-level view of potential adoption and the primary touchpoint, nevertheless it doesn’t inform us a lot in regards to the variety of customers utilizing bitcoin for its main objective: decentralized peer-to-peer money the place customers can retailer and transact worth on a separate financial community. Ideally, we need to observe the expansion of heavy customers to replicate significant adoption of bitcoin.

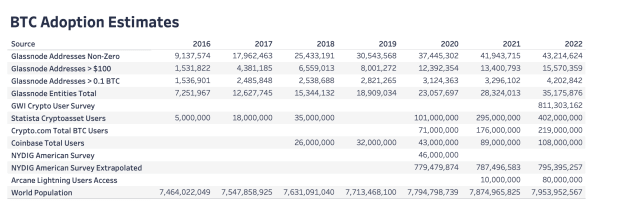

The beneath desk aggregates a number of the key bitcoin consumer estimates which have been revealed during the last six years to provide you an thought of how various these estimates could be. Taking a look at casually customers, numbers from 2022 vary from 200 to 800 million customers. These are counts from survey samples, information from on-chain analytics and contains alternate customers. All of those research have completely different definitions and methodologies for calculating adoption, exhibiting how troublesome it’s to match estimates on the market right now.

Expertise Adoption S-Curve: Web Versus Bitcoin

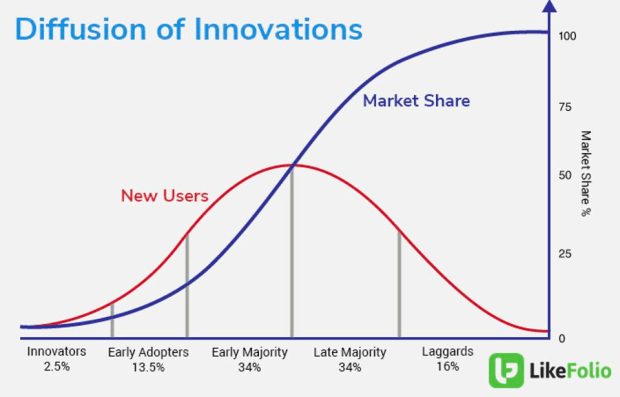

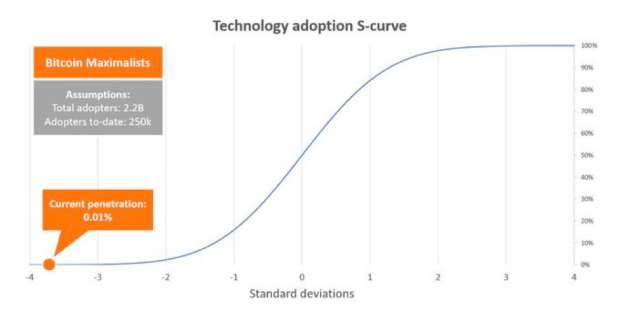

New applied sciences sometimes undergo an S-curve cycle as they achieve market share. Adoption by the inhabitants falls right into a typical statistical bell curve. An S-curve simply displays the everyday adoption path for progressive applied sciences over time.

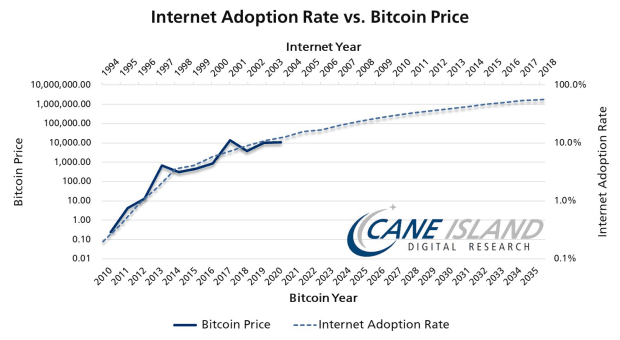

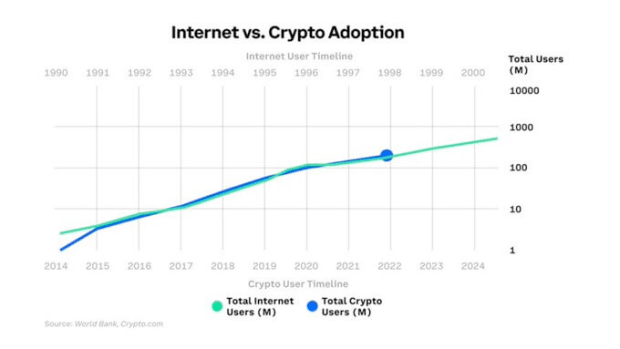

Lots of the traditional projections for S-curve adoption use a extra high-level view of the casually customers to trace bitcoin development in comparison with web adoption. Mainly, these estimates observe customers of every kind: those that have had any contact factors with bitcoin from shopping for somewhat bit on an alternate, having a pockets with $5 value of bitcoin to the bitcoin consumer storing higher than 50% of their internet value in self custody.

Monitoring casually customers would give individuals a ballpark estimate of across the identical adoption curve because the web. Nevertheless, if we’re actually occupied with monitoring significant, lasting bitcoin adoption then we’d argue that monitoring the variety of heavy customers is a greater measure for the present state of bitcoin adoption and emphasizes simply how early in Bitcoin’s lifecycle we’re. When wanting on the extra common evaluation comparisons which have beforehand circulated (included beneath), they paint an image that bitcoin adoption is way additional alongside than we calculate it to be.

In 2020, Croseus wrote a thread that analyzes bitcoin adoption in the same means that we got down to do on this piece. His conclusions present the same view to our personal: Vital bitcoin adoption is way decrease than the estimates of 10-15% penetration or roughly 500 million customers which are generally thrown round right now. In reality, he means that bitcoin adoption by what we’d think about “heavy customers” is at 0.01% penetration of the worldwide inhabitants.

Addresses

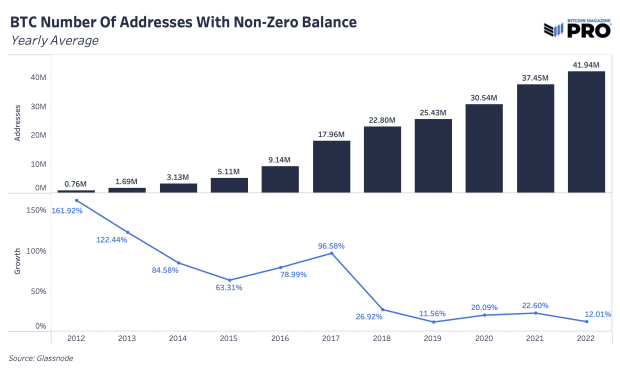

The simplest place to start out with estimating customers is on-chain addresses. Addresses don’t translate to the variety of customers, however can act as a tough proxy for general development. Distinctive addresses with bitcoin quantities could be rising as new customers purchase bitcoin or as present bitcoin holders use many distinctive addresses to unfold out their holdings — a typical privateness apply.

We’ve seen an explosion in handle development since 2012 from slightly below 1 million to just about 42 million distinctive addresses right now. Let’s say we use an assumption for common addresses per individual to be 10 — which is only a tough guess — then the ceiling of bitcoin customers who’ve their very own addresses is round 4.2 million.

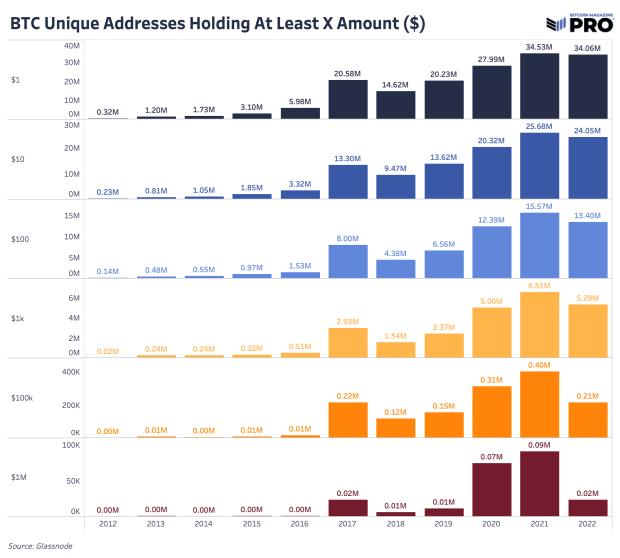

From a USD perspective, there are solely 5.3 million addresses holding at the very least $1,000 value of bitcoin. Utilizing our tough assumption of 10 addresses per individual once more then we’re underneath 1 million customers with $1,000 value of bitcoin. With a worldwide median wealth per grownup of $8,360, a bitcoin allocation of $1,000 would make up a big share of almost 12%. A comparatively small allocation for some, however contemplating bitcoin is international and has increased adoption charges in much less rich international locations, the benchmark appears becoming.

Utilizing our definition of “heavy consumer” to calculate, if we use addresses with a sure threshold of BTC or USD and make some tough assumptions round addresses per individual together with not counting alternate customers or addresses holding bitcoin on the behalf of others, then this strategy estimates solely 593,000 bitcoin customers.

We go into extra element about different methods to research bitcoin customers in an article on Substack. Regardless of which means you chop the information, there’s not a considerable amount of the worldwide inhabitants who can be thought of heavy customers who self-custody a big threshold of bitcoin.

Conclusion

The evaluation on this article is supposed to focus on how troublesome it’s to outline and observe bitcoin consumer development in a dependable means.

We’re highlighting a decrease penetration of adoption to not dissuade readers from the expansion of bitcoin’s community results thus far, however moderately to focus on the substantial alternative of its potential development sooner or later.

Like this content material? Subscribe now to obtain PRO articles instantly in your inbox.

Related Articles:

- BM Professional Market Dashboard Launch!

- Bitcoin Rips To $21,000, Shorts Demolished In Greatest Squeeze Since 2021

- Bitcoin Sellers Exhausted, Accumulators HODL The Line

- Time-Primarily based Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market Apathy

- 2022 12 months In Overview

from Bitcoin – My Blog https://ift.tt/OPqHeSU

via IFTTT

No comments:

Post a Comment